flow through entity tax break

The bill also would amend the Act to allow for the 2016 2017 2018 and 2019 tax. Gretchen Whitmer signed HB 5376 allowing eligible owners of pass-through entities to have the pass-through entity pay Michigan taxes at the entity level and then receive a refundable credit on their own tax return for their share of the entity level Michigan tax paid.

A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax.

. The Michigan flow-through entity tax which was signed into law on December 20 2021 is retroactive to January 1 2021 for certain electing flow-through entities. Retroactively effective for tax years beginning on or after January 1 2021 the law allows individual taxpayers with interests in partnerships or S corporations to reduce their federal. The Tax Cuts and Jobs Act TCJA the massive tax reform law that took effect in 2018 established a new tax deduction for owners of pass-through businesses.

1 As a result Michigan is the latest state to enact an entity-level tax regime as a workaround to the federal 10000 state and local tax SALT deduction limitation adopted under the Tax Cuts and Jobs Act TCJA of 2017. An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a corporate tax code. Flow-through entities are a common device used to avoid double taxation on earnings.

The MI flow-through entity tax is retroactive to Jan. Under the Tax Cuts and Jobs Act pass-through business entity owners can potentially deduct 20 of their business income. PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner levels.

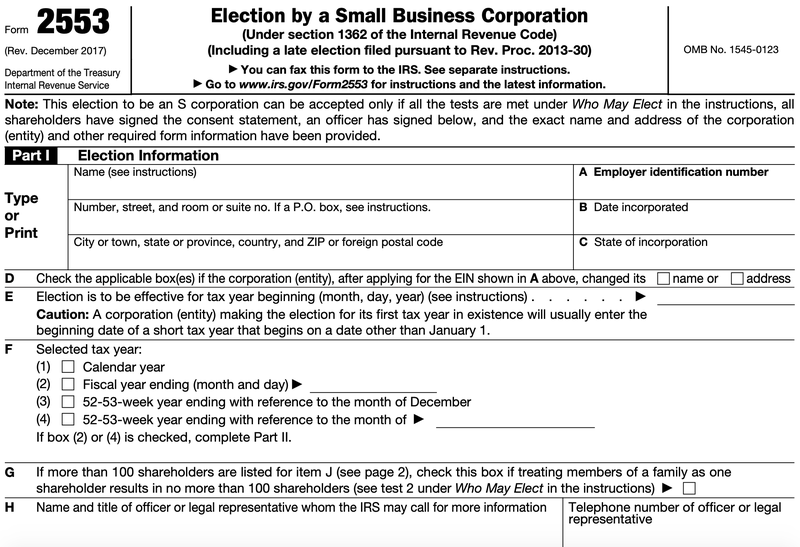

The majority of businesses are pass-through entities. Fourth quarter estimated tax payment for calendar year flow-through entities electing into the tax are due Jan. With an election in place and payment of the necessary taxes the pass-through entity can then deduct the amount of taxes paid without limitation on their federal tax returns Form 1120S for S corps Form 1065 for partnerships.

Common Types of Pass-Through Entities. For calendar year flow-through entities that have elected into the tax the fourth quarter estimated tax payment is due. A flow-through entity that elected to pay the proposed flow-through entity tax to claim a credit against the individual income tax or Corporate Income Tax.

By Stephen Fishman JD. Shareholdersmembers of such pass-through entities can then claim a credit on their Michigan individual income tax returns for. Every profit-making business other than a C corporation is a flow-through entity including sole proprietorships.

20 2021 Michigan Gov. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals. 2 On the same day.

20 2021 to provide an elective flow-through entity FTE tax. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes. For individual owners the new provisions provide relief from the federal income tax.

1 2021 for certain electing flow-through entities and those entities may be required to pay quarterly estimated tax payments. 2021 PA 135 introduces Chapter 20 within Part 4 of the Income Tax Act to create and levy a flow-through entity tax on electing flow-through entities with business activity in Michigan effective January 1 2021. Whitmer signed House Bill 5376 into law which amended the Michigan Income Tax Act by implementing an elective flow-through entity tax.

Electing flow-through entities may be required to pay quarterly estimated tax payments. Generally the flow-through entity tax allows a flow-through entity to elect to pay tax on certain income at the individual income tax rate with members of that entity eligible to. Some key takeaways for tax and accounting professionals include.

Gretchen Whitmer signed legislation on Dec. The tax break allows owners of pass-through businesses like sole proprietors partnerships and S corporations to deduct up to 20 of their business income from taxes. With flow-through entities the income is taxed only at the owners individual tax rate for ordinary income.

Elective Pass Through Entity Tax Wolters Kluwer

A Beginner S Guide To Pass Through Entities The Blueprint

Whats The Pass Through Deduction The Owners Of Many Pass Through Entities Such As Partnership S C S Corporation Small Business Accounting Sole Proprietorship

Benefits Of Incorporating Business Law Small Business Deductions Business

Elective Pass Through Entity Tax Wolters Kluwer

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

4 Types Of Business Structures And Their Tax Implications Netsuite

Legal Entity Business Checklist Start Up Start Up Business

Pass Through Income Definition Example Investinganswers Financial Statement Analysis Income Definitions

7 Steps On How To Start A Business Checklist For Steady Growth Business Checklist Business Structure Bookkeeping Business

Concept Of Input Tax Credit Is Described By Accounting Courses In Chandigarh For More Information Cal Tax Credits Accounting Course Life And Health Insurance

Pin By Stephanie Scott On Therapy In 2022 Successful Business Tips Money Management Advice Small Business Advice

Man Makes Ridiculously Complicated Chart To Find Out Who Owns His Mortgage Chart How To Find Out Flow Chart Chart

Pass Through Entity Definition Examples Advantages Disadvantages

What The New Tax Bill Means For Small Business Owners Freelancers Business Tax Deductions Small Business Finance Business Tax

Pass Through Entity Definition Examples Advantages Disadvantages